From no-code solutions, to simply having better processes, set your business up to scale. We can easily take over your books in Quickbooks online, Quickbooks live, Xero, Merritt Bookkeeping, bookkeeper.com, or any other third-party platform. We are happy to discuss the needs of your business and determine the best fit for you. Online bookkeeping is the most efficient way to track your revenue and expenses and ensure you stay in the black.

Bookkeeper is one of the pricier business bookkeeping services on our list, but it comes with many possible add-on services. If you’re looking for a bookkeeping solution you can stick with for the long run, Bookkeeper has most bookkeeping features you could possibly want as an add-on. Possible add-ons include payroll services, individual and business tax returns, and financial performance reporting with key performance Profit and Loss Aptitude Questions and Answers indicators. In addition to being one of the best online bookkeeping services around, FreshBooks offers 100% compliant tax preparation, taking the stress out of this important but time-consuming process. QuickBooks Live started off as an online software platform for bookkeeping, which also offers its own bookkeeping service – basically a live help or how-to coupled with the industry standard software.

As your business grows and your financial transactions increase, you will need a virtual bookkeeper to do routine tasks, like classifying transactions and reconciling bank accounts. 1-800Accountant reviews show that its dashboard is user-friendly and easy to navigate. Users also praised the virtual accounting firm’s business formation services and the transparency of fees and services. You can use its monthly financial reports to assist with filing taxes, and it provides a simplified issuance and electronic filing of 1099s for your contractors at an additional fee. While it lacks its own mobile app, you can use QuickBooks Online’s app to access your books. It’s ideal for businesses looking to outsource their bookkeeping with a full-service accounting firm.

In the business of bookkeeping, connecting with new clients to your business is a lot like making friends or even dating. It doesn’t happen in one day; it can take a couple of meetings before you both trust each other enough to commit to building a relationship. Of course, you can’t run a profitable business unless you’re good at what you do, no matter how much potential the industry has. Before you decide to pursue a bookkeeping business, you need to make sure it suits your skillset and strengths. With private-label or white-label accounting software, you get the freedom to customize the application as per your needs. You can host it on your server, distribute it under your brand and sell it at your price.

Starting A Bookkeeping Business

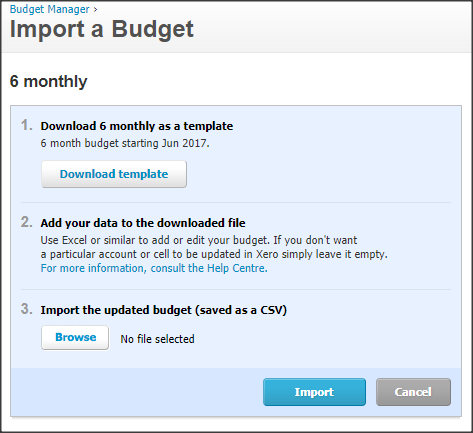

This feature saves you the time and effort of manually uploading documents. If you’re several years behind on your bookkeeping and taxes, you can get caught up and filed with Bench Retro. If you’re switching from QuickBooks, we’ll work from your closing balances to do your bookkeeping going forward.

Rely on a certified team, who knows how to maximize each tool. Accrual accounting records income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid. As a business owner, you are more efficient in making business decisions when you have access to your P&L and financial statements (AR’s and AP’s) in real-time. Our certified QuickBooks ProAdvisors make sure you have this up-to-date, real-time information ready when you need it. Remote Books Online gets your bookkeeping completed and financial statements ready for filing taxes.

When you connect your bank and credit card, your professional bookkeeping team gets access to your transaction history and your account statements — nothing more, as we respect your financial data. Your bookkeeper categorizes your business transactions and reconciles accounts to prepare your monthly statements and financial reports. Bookkeeping is often a pain point for entrepreneurs, small businesses, and startups. Remote Books Online takes away your pain and frustration with affordable, flexible, and accurate bookkeeping solutions for businesses of all shapes and sizes. No business is too big, too small, or too unique for our monthly bookkeeping service. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries.

Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books. Receive personalized insights including your profit and loss report and balance sheet. This helps inform your business decisions and gives you time to do what you do best.

Merritt Bookkeeping

When deciding whether to use online bookkeeping services, it’s best to consider the amount of time (and therefore, the amount of money) that you’ll save with accounting software and a dedicated bookkeeper. Virtual bookkeeping services are very beneficial especially for small and medium-size companies in the term of low cost and access all financial secure data anywhere on any devices. Virtual bookkeeper uses different online accounting software`s and record financial transactions, review and updates statements and reconciles accounts. Most common online accounting software`s are QuickBooks, Xero, and Wave accounting software. Benefits of virtual bookkeeping services areReal-time information. LessAccounting support is free forever and included in your bookkeeping services.

Bookkeepers take on the role of serious responsibility since they take care of sensitive information for clients and promise to keep records accurately. The digital age has brought endless possibilities to start online businesses of all shapes and sizes, so there’s something out there for all types of people. Get the benefits of a professional bookkeeper at a price you can afford, and powerful financial reporting software with zero learning curve. Clients can contact their team members during business hours from their computers or mobile app and expect a response within one business day or they can schedule a call. If you already work with an accountant or CPA, chances are good they prefer to work with QuickBooks rather than with proprietary software like Bench. Once you complete a short questionnaire, Paro works with you to find the right match based on the size of your business, the financial role that needs to be filled, and your industry.

- This service prides itself on customer satisfaction, with a team of bookkeepers on call, as well as a dedicated bookkeeper who will teleconfer with you and go over your financial reports.

- If you already are using an accounting or bookkeeping software program, it would be ideal to work with a firm that utilizes the same software.

- Block Advisors is a branch of H&R Block that provides tax, bookkeeping, and payroll support.

- Our easy-to-use online accounting services for small businesses allow you to conveniently contact us, view important statements, and take advantage of valuable financial insights anytime.

If you don’t already use a software program, the accounting firm will recommend a package. For businesses on a growth track, the cost of not outsourcing bookkeeping and accounting can be detrimental to the business. This happens when performing the functions in-house interferes with essential business growth activities. Every hour you spend on bookkeeping or accounting is one less hour spent marketing your business, building client relationships, and other business development activities. At some point, the cost to your business in terms of lost growth opportunities becomes immeasurable.

Bench

However, if you want more advanced reporting and a more robust mobile experience, you’re better off looking at other solutions on this list. Billy/Sunrise also got some bad reps for its choices regarding customer loyalty when it was acquired. We consider the opinion of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found. Business Network International (BNI) is a platform where members meet weekly to discuss business and support each other’s businesses by sharing referrals.

With Mazuma’s virtual bookkeeping services, you’ll never stress about your books or taxes. QuickBooks Live Bookkeeping is an online bookkeeping service that connects small businesses with trusted, QuickBooks-certified virtual bookkeepers. Your bookkeeper takes the lead on your bookkeeping and runs essential reports so you can focus on your business. Sunrise, by Lendio, used to be called Billy until it was acquired. It’s known for its easy-to-use interface and its simplification of accounting jargon.

- Get Your Account Setup

Well introduce you to a dedicated bookkeeper. - A downside of Bench is that it specializes in cash-basis accounting, although there is a custom accrual accounting plan on the Pro plan.

- QuickBooks Live started off as an online software platform for bookkeeping, which also offers its own bookkeeping service – basically a live help or how-to coupled with the industry standard software.

- It requires core knowledge of finance, accounting, and taxation.

It also offers limited support for business taxes by preparing a year-end financial package for your CPA. You can pay for additional tax services by adding BenchTax to your bookkeeping services. The challenge for small businesses is finding the right accounting firm out of the dozens available to fit their needs. Using a set of criteria that includes cost, range of services, software compatibility, and small business expertise, we reviewed 20 online accounting firms to find the best in five categories. Our team moves quickly so you can make informed decisions faster.

Expert Bookkeeping – Simple, and Stress-Free.

Its bookkeeping services include a free, 30-minute consultation with an account manager, a review of your books year-to-date, and an action plan created each quarter with specific recommendations. Its plans are affordable and can be customized based on your needs. Your team of small business experts imports bank statements and prepares financial statements every month. Your Bench bookkeeper works in-house, and they’re backed by our in-house research team to provide you with informed answers to complex questions.

Save precious hours every week with our all-in-one accounting solution built for you – the entrepreneur.

In addition to its real-time dashboard, which offers self-support features, clients can tap into inDinero’s support team via phone, email, or live chat. At times, your bookkeeper might need input from you on things like categorizing a transaction. If you have any questions, you can send your bookkeeper a message or book a call – there are no extra charges for support for the business owner.

How You Can Benefit From Remote Bookkeeping

From that point on, you will receive monthly reports, including cash flow, profit and loss, and balance sheet statements. 1-800Accountant offers a nationwide team of Certified Public Accountants (CPAs), enrolled agents, tax professionals, and other experts lending their expertise to a full array of accounting services. Clients are matched with a local accountant or bookkeeper who can provide state- and industry-specific guidance in managing their books. Scrambling at the last second to gather documents for tax season is stressful, and rushing bookkeeping-related tasks can make you vulnerable to compliance issues and missed growth opportunities. Thankfully, online bookkeeping services have lowered the financial barrier to getting bookkeeping and tax-related help. The leading online bookkeeping services offer many levels of security.

For example, if someone sues you, you could potentially go bankrupt and lose all your assets. While legal should not be ignored (documentation, in particular, is an area that start-ups ignore), registration costs should be kept as low as possible. The good news is that there aren’t many costs involved in starting a bookkeeping business. Assuming you already have a good laptop, you won’t need to buy much – you can do the work straight from your computer. But there’s more to bookkeeping than this – most business owners don’t just want to know the numbers, they want to understand them, too. This means looking at assets, liabilities, equity, and profit, and figuring out what they mean for the business in question.